Annual federal withholding calculator

If you have a third job enter its annual income. Medicare Withheld 000.

What Does 11 Form Look Like What Does 11 Form Look Like Is So Famous But Why Tax Forms Irs Tax Forms Income Tax Return

It describes how to figure withholding using the Wage Bracket Method or Percentage Method describes the alternative methods for figuring withholding and provides the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members.

. The amount you earn. Free Federal and New York Paycheck Withholding Calculator. While increasing your retirement account savings does lower your take home pay it also lowers your Federal income tax withholding.

Total Disposable Pay Minus Amount Above c. Subtract any deductions and payroll taxes from the gross pay to get net pay. 25 of Disposable Pay Minus Amounts Withheld Under Other Wage Withholding Orders with Priority 7.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Fields notated with are required. For employees withholding is the amount of federal income tax withheld from your paycheck.

This publication supplements Pub. First use the worksheet found on page 5 of IRS Pub 15-T to calculate the adjusted annual wage amount. For help with your withholding you may use the Tax Withholding Estimator.

2007 Benefits Administration. To change your tax withholding amount. If you have a third job enter its annual income.

Free Federal and Missouri Paycheck Withholding Calculator. Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that varies by. When you complete your Form 1040 and its attached schedules you enter all your income from various categories such as wages interest and dividends and business income.

Use this calculator to determine the Total Number of Allowances to enter on your Massachusetts Tax Information in Employee Self-Service. 51 Agricultural Employers Tax Guide. Once you have the adjusted annual wages you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount.

P15 Enter Extra Federal Tax Withholding. Your employer withholds the amount you specifybased on how you fill out the state OR-W-4 and federal W-4 and sends them to the Oregon Department of Revenue and the IRS where its applied to your tax. If you are at least 65 unmarried and receive 14250 or more in non-exempt income in addition to your Social Security benefits you typically must file a federal income tax return tax year 2021.

Total annual cost to hire this employee. If you participate in a 401k 403b or the federal governments Thrift Savings Plan TSP the total annual amount you can contribute is increased to 19500 26000 if age 50 or older. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Account for dependent tax credits. Figure the tentative tax to withhold. 15 Employers Tax Guide and Pub.

This also applies to most 457 plans. We show both the initial mandated federal withholding of 24 as well as the remaining federal taxes that will be due. 30 average annual payments of 9233333.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as. Federal W4 Withholding Status W-4 Cheat Sheet. Start 14-day free trial See all features.

Your Estimated Annual IRS Tax Withholding 000. Enter pay periods per year of your highest paying job. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

These pages contain the Benefits Administration Letters BALs used for program administration. Pre-Tax Deduction 000. Taxes you pay as an employer which include federal and state-level unemployment taxes.

Dont want to calculate this by hand. Then you take various above-the-line deductions such as contributing to an IRA or. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer.

Withholding is the portion of your wages you have withheld from your paychecks to cover your anticipated annual income tax liability. 401k403b plan withholding This is the percent of your gross income you put into a taxable deferred retirement account such as a 401k or 403b. How Your Paycheck Works.

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. Ask your employer if they use an automated system to submit Form W-4.

2022 W-4 Help for Sections 2 3 and 4. The gross wages of the employees last payroll are too low. Other Estimated Annual Paycheck Totals.

For example if you earn 2000week your annual income is calculated by taking 2000 x 52 weeks for a total salary of 104000. If the only income you receive is your Social Security benefits then you typically dont have to file a federal income tax return. The Tax Withholding Calculator Will Guide You Through The W-4 Form.

Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. The information you give your employer on Form W4. Enter pay periods per year of your highest paying job.

The total annual salary exceeds the salary limit. The federal withholding taxes are not calculating for some of our employees. They are all using the 2020 W-4 form.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. We welcome your comments about this publication and suggestions for future editions. The PaycheckCity salary calculator will do the calculating for you.

Your total federal income tax owed is based on your adjusted gross income AGI. NW IR-6526 Washington DC 20224. If your spouse is not working or if she or he is.

The Form W4 Withholding wizard takes you through each step of completing the Form W4. Submit or give Form W-4 to your employer. Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee.

Office of Personnel Management OPM has Government wide responsibility and oversight for Federal benefits administration. How do you calculate annual income. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

This tech very helpful and had me download the IRS calculator excel worksheet. Increase or Decrease your W-2 Paycheck Tax Withholding by Pay period. The amount of income tax your employer withholds from your regular pay depends on two things.

Amount Equivalent to 30x the Federal Minimum Wage of 725 based on your pay frequency Weekly or less 21750 Every other week 43500 2x per month 47125 Monthly 94250 b. Use your estimate to change your tax withholding amount on Form W-4. The impact on your paycheck might be less than you think.

This number is the gross pay per pay period. Or keep the same amount. The initial state withholding taxes are based on published guidance from each state lottery and the final state tax rates are from state government publications.

If you work for more than one employer at the same time you must not claim any exemptions with employers other than your principal employer. Federal W4 Withholding Status W-4 Cheat Sheet. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52.

The BALs provide guidance to agencies on various aspects of Federal administration. 2022 W-4 Help for Sections 2 3 and 4. The Form W4 provides your employer with the details on how much federal and in some cases state and local tax should be withheld from your paycheck.

How to calculate Federal Tax based on your Annual Income.

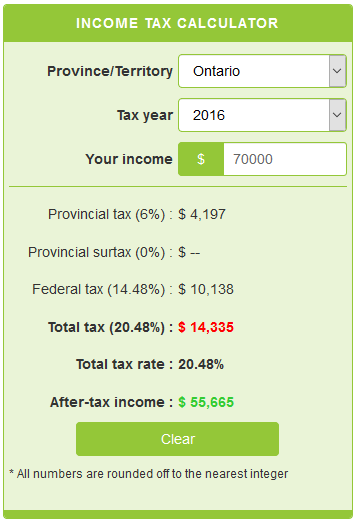

Avanti Income Tax Calculator

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Python Income Tax Calculator Income Tax Python Coding In Python

Pin On Raj Excel

How To Calculate Federal Income Tax

Income Tax Calculator Calculatorscanada Ca

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Paycheck Calculator Take Home Pay Calculator

Get Our Sample Of Employee Payroll Register Template For Free Payroll Template Payroll Pen And Paper

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

Self Employed Tax Calculator Business Tax Self Employment Self

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Ontario Income Tax Calculator Wowa Ca

How To Calculate Income Tax In Excel

2021 2022 Income Tax Calculator Canada Wowa Ca

Pin On Usa Tax Code Blog